If inadvertently, GST has been paid under the wrong head like IGST instead of CGST / SGST, the remedy available to the assessee is to seek refund of the amount wrongly paid. Recently, a functionality has been provided to the taxpayers on GST Portal to claim Refund of Excess amount in their Electronic Cash ledger.

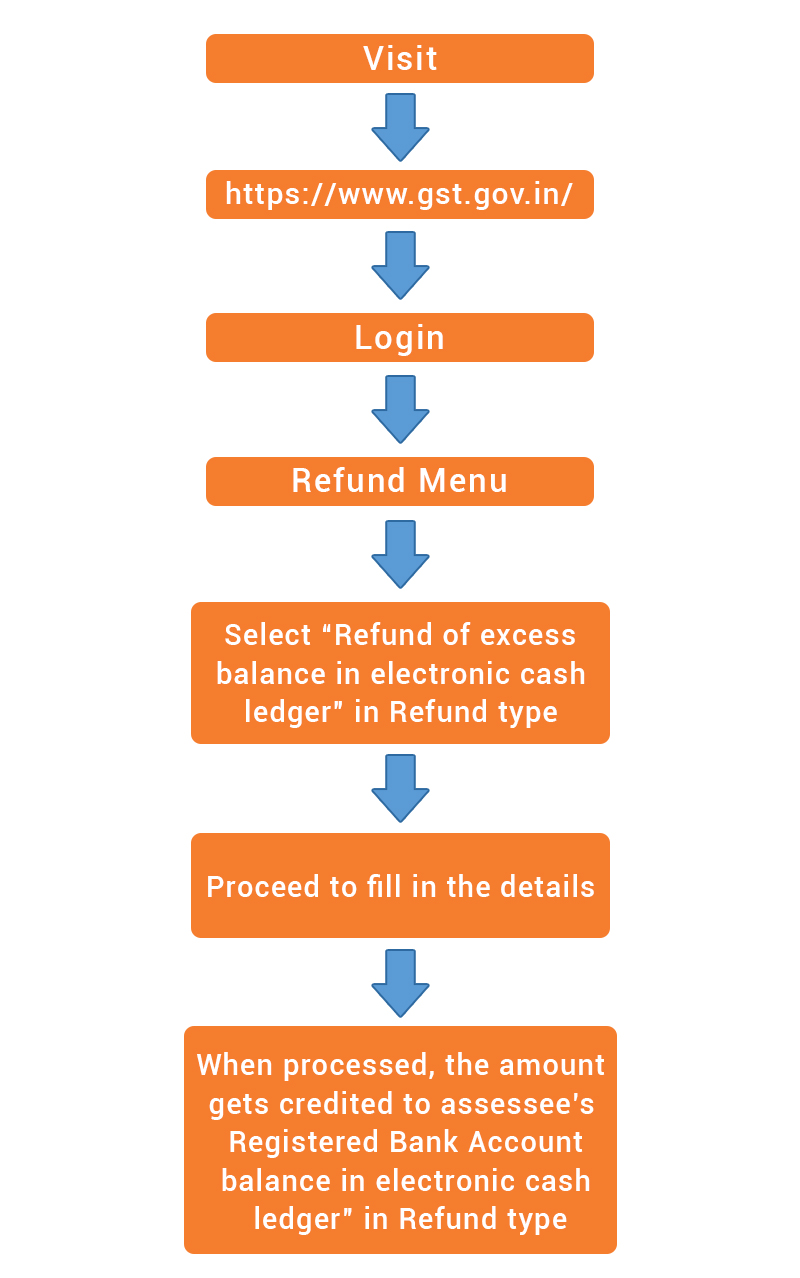

Those taxpayers, who wish to claim this Refund, may apply through the procedure given below:-