Internal Financial Controls – Applicability on Private Limited Companies

As per provisions of Section 143(3)(i) of companies Act, The Auditor Report shall state whether the Company has adequate internal financial controls system inplace and the operating effectiveness of such controls.

MCA vide its notification dated 13th June 2017 (G.S.R. 583(E)) amended the notification of the Government of India, In the ministry of corporate of affair, vide no G.S.R. 464(E) dated 05th June 2015 providing exemption from Internal Financial Controls to following private companies:

- Which is one person Company (OPC) or a Small Company; or

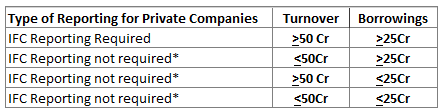

- Which has turnover less than Rs. 50 Crores as per latest audited financial statement or which has aggregate borrowings from banks or financial institutions or any body corporate at any point of time during the financial year less then Rs. 25 Crore.

The above exemption shall be applicable to a private company which has not committed a default in filing its financial statements under section 137 of the Companies Act 2013 or annual return under section 92 of CA 2013 with the Registrar.

Opinion

Based on above legal position, in case of

- One Person Company (OPC), or

- Small Companies or

- Private companies with turnover less than 50 Crore or

- Private Companies aggregate borrowings less than 25 Crore

The auditor is not required to report about the internal financial controls system in place. However, the exemptions available to Private Company under section 143(3)(i) would be available only if private company has not committed a default in filing its financial statements under section 137 of the said Act or annual return under section 92 of the said Act with the Registrar.

Note 1 One person company means a company which has only one person as a member.

Note 2 Small Companies means

a. paid-up share capital of which does not exceed fifty lakh rupees or such higher amount as may be prescribed which shall not be more than five crore rupees; or

b. turnover of which as per its last profit and loss account does not exceed two crore rupees or such higher amount as may be prescribed which shall not be more than twenty crore rupees:

Provided that nothing in this clause shall apply to-

(A) a holding company or a subsidiary company;

(B) a company registered under section 8; or

(C) a company or body corporate governed by any special Act;

Scenarios

Practical Issues

- Is Internal Financial Report once applicable, applicable forever?

- As per exemptions as mentioned above, some private companies are not required to report on Internal Financial Controls (IFC). Do we need to consider the same while reporting under consolidated financial statement or exempted companies are required to report on Internal Financial Controls (IFC) as well because of applicability on Parent company?

- What is the meaning of committed default and at what point of time default need to be seen? If default is made good then whether exemption is available prospectively or retrospectively from the date when the default started.