On April 19, 2022, the International Financial Services Centres Authority (IFSCA) published the International Financial Services Centres Authority (Fund Management) Regulations, 2022 (“FM Regulations”) overhauling the fund regime in International Financial Services Centre (IFSC) and introduced Family Investment Funds for managing the financial affairs of a single family.

FUND STRUCTURE:

A Family Investment Fund (FIF) may be structured as:

- Company

- Limited Liability Partnership

- Trust (Contributory Trust)

CORPUS:

- Corpus of USD 10 million to be raised within a period of 3 years from the date of registration.

- May be open ended or close ended.

OTHER KEY CONSIDERATIONS:

- Leveraging and borrowing permissible, as per risk management policy.

- Mandatory to have an office that needs to be managed by principal officer in Gift City.

- FIF may set-up additional investment vehicles which results a conduit to bifurcate financial holdings between different members of a single family.

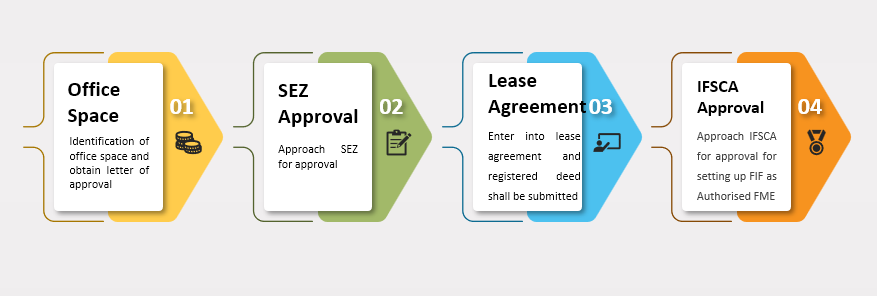

PROCESS OF SETTING UP FIF:

The process of setting up of FIF in IFSC is stated below:

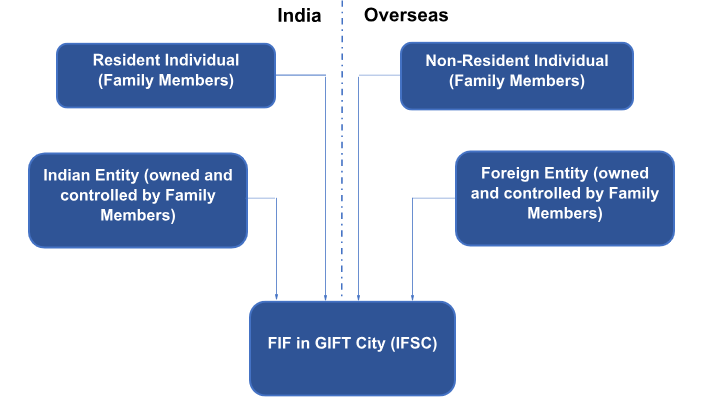

CONTRIBUTORIES IN FIF:

- The FM Regulations read with circulars issued thereunder, have permitted following persons to contribute to the corpus of FIF: –

- Members of Single family

- Entities where single family holds 90% economic interest directly or indirectly

- Employees, directors, fund management entities or other persons including service providers can have economic interest up to 20% of profits of FIF

- Resident individuals are permitted to make overseas investment in FIF under ‘Overseas Portfolio Investment’ Route by using their LRS limits i.e., upto USD 2,50,000 each financial year. Additionally, Indian body corporates may also invest in FIF under OPI Route up to 50% of their net worth.

PERMITTED INVESTORS:

PERMISSIBLE ACTIVITIES AND INSTRUMENTS:

The investments made by a FIF overseas is not required to comply with the provisions of extant regulations on overseas investments. Additionally, the FM Regulations has permitted FIF to make following investments: –

| Unlisted/Listed Securities | Securitised Debt Instruments | Mutual Funds/ VCFs/ AIFs |

| Exchange traded funds | Derivatives | Money market instruments |

| Investment in Limited Liability Partnerships | Physical assets (real estate, bullion, art etc.) | Other investment schemes |

BENEFITS OF SETTING UP FIF:

Under Income Tax:

- 100% tax exemption for 10 consecutive years out of 15 years under section 80LA of Income tax Act, 1961

- MAT/AMT @ 9% of book profits under section 115JB (7) of Income tax Act, 1961

- MAT not applicable in case of opting for new tax regime under section 115BAA for certain domestic companies or 115BAB for new manufacturing domestic companies of Income tax Act, 1961

- Dividend income to be taxed in the hand of Shareholder

- Dividend income for NR shall be taxed @ 10%

Under GST:

- No GST on services received by unit in IFSC

- No GST on transactions carried out in IFSC exchanges

Other Benefits:

- NRI or foreign entities owned and controlled by Family members can invest in FIF without limit

- No minimum net-worth requirement

- Cost effective and less compliance burden viz-viz an AIF

For details, please refer International Financial Services Centres Authority (ifsca.gov.in) and International Financial Services Centres Authority (ifsca.gov.in)

PDF version is attached: https://dpncindia.com/wp-content/uploads/2023/09/Family-Investment-Fund-FIF.pdf

DISCLAIMER: –

The summary information herein is based on The International Financial Services Centres Authority Act, 2019 and International Financial Services Centres Authority (Fund Management) Regulations, 2022. While the information is believed to be accurate, we make no representations or warranties, express or implied, as to the accuracy or completeness of it. Readers should conduct and rely upon their own examination and analysis and are advised to seek their own professional advice. This note is not an offer, advice or solicitation. We accept no responsibility for any errors it may contain, whether caused by negligence or otherwise or for any loss, howsoever caused or sustained, by the person who relies upon it