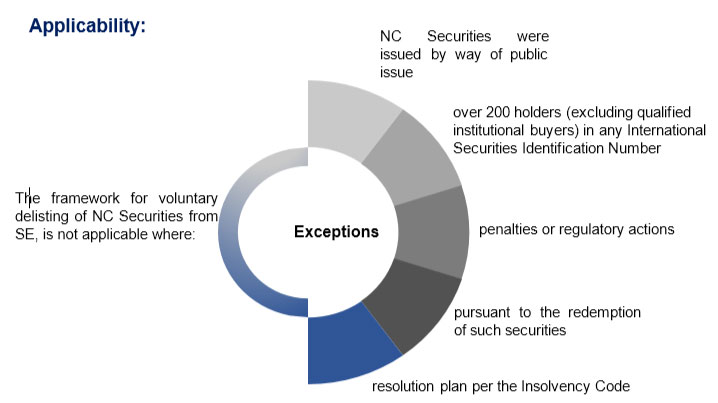

The Securities and Exchange Board of India (“SEBI”) have included framework for voluntary delisting of non-convertible redeemable preference shares and non-convertible redeemable preference shares (collective “NC Securities”) from Stock Exchange (“SE”) by inserting Chapter VIA to the Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations, 2015 (“LODR”)

Requirement of in-principle approval of the SE:

The SE must consider factors:

- board’s approval

- investor grievance resolution

- listing fees

- compliance litigation, non-payment of penalties or restrictions.

Obligation of the Listed Entity:

- Seeking in-principle approval for delisting of NC Securities. Application for in-principle approval shall be filed with SE within 15 working days of passing of board resolution.

- Events of delisting to be discloses to SE as Material Information as per Regulation 51 of LODR.

- Disclosure of prescribed information on the website of Company and SE within two working days of receiving in-principle approval.

- Sending of notice of delisting to NC Securities holders within three working days of receiving in-principle approval from SE. The notice must include all required disclosures, in-principle approval and e-voting provisions.

- Obtaining of approval from NC Securities holders within 15 days of delisting notice and obtain No-Objection Letter from debenture trustee.

- Submission of final application for delisting within five working days of receiving approval of NC Securities holders.

Delisting from some of the SE:

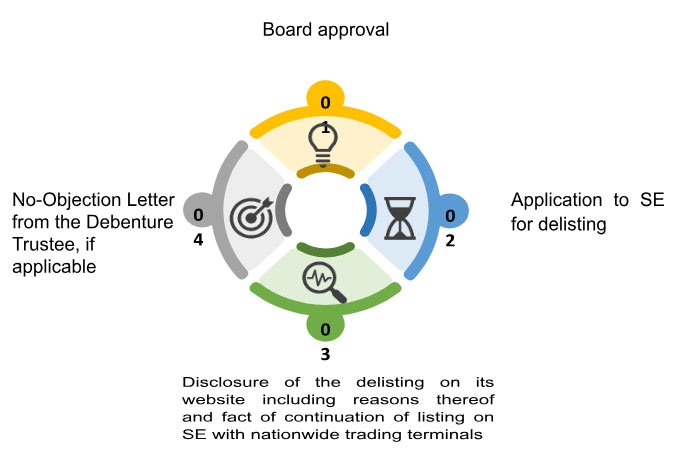

The listed entity may choose to delist NC Securities from multiple SE, except one with nationwide trading terminals. The process of such partial delisting is as shown below:

The application must be completed within 30 working days.

Please find link for details SEBI | Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) (Third Amendment) Regulations, 2023

PDF version is attached: https://dpncindia.com/wp-content/uploads/2023/09/SEBI-Voluntary-Delisting.pdf

DISCLAIMER: –

The summary information herein has been compiled by our expert regulatory team based on The Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) (Third Amendment) Regulations, 2023. While the information is believed to be accurate, we make no representations or warranties, express or implied, as to the accuracy or completeness of it. Readers should conduct and rely upon their own examination and analysis and are advised to seek their own professional advice. This note is not an offer, advice or solicitation. We accept no responsibility for any errors it may contain, whether caused by negligence or otherwise or for any loss, howsoever caused or sustained, by the person who relies upon it.